German and Japanese Electric Power Industries Embark on the Practical Applications of Hydrogen Energy

© DWIH Tokyo/iStock.com/Petmal

© DWIH Tokyo/iStock.com/Petmal

February 25, 2021

[by Toru Kumagai]

The Federal Government of Germany published its national hydrogen energy strategy in June 2020, revealing that hydrogen will be one of the pillars for reducing carbon dioxide (CO2) emissions, as reported in the first article of this series. Research institutes and electric power companies in Germany as well as in Japan are currently propelling projects for the practical use of hydrogen energy.

Germany in Plan to Replace Fossil Fuels with Hydrogen

According to the strategy announced by Anja Karliczek, Federal Minister of Education and Research, and Peter Altmaier, Minister of Economics and Energy, the German government will invest a total of 9 billion euros (1.8 trillion yen at an exchange rate of 120 yen to the euro) in the research and development of hydrogen energy. Particular emphasis will be placed on “green hydrogen,” which is produced by electrolysis of water using only electricity from renewable energy sources. The resulting hydrogen will be commonly utilised as an energy source for steel and chemical plants. The government will also promote new synthetic fuels (electrofuels) derived from green hydrogen to replace diesel fuel which powers buses, trucks, ships, aircraft, and other large forms of transportation.

Hydrogen Cluster to be Installed in Lower Saxony

German power and manufacturing companies are actively conducting demonstration experiments for the practical use of hydrogen energy. RWE, the country’s largest electricity company, for example, is participating in a hydrogen practical application project (GET H2 Initiative) conducted in the city of Lingen, Lower Saxony (the Emsland region). Lingen’s proximity to the coast of the North Sea makes it easy to procure eco-friendly electricity generated by offshore wind farms.

The project aims to build Germany’s first “hydrogen industrial energy zone.” The concept behind the scheme is to create an infrastructure and a value chain in the area around Lingen for the production, storage, and transport of green hydrogen, thereby linking the energy, manufacturing, heating, and transportation sectors.

Participating companies will build two electrolysis facilities with a production capacity of 105 megawatts (MW). The green hydrogen produced there will then be stored in existing underground gas tanks or used to manufacture synthetic fuels for transportation. An experiment is planned in 2022 to transport green hydrogen via a 130-kilometer-long gas pipeline from Lingen to the industrial zone located in North Rhine-Westphalia.

Altogether this represents the first-ever attempt to create a large-scale cluster for the production of industrial hydrogen in Germany. A number of private companies and research institutions are involved in this project, some of which are listed below:

• RWE Generation SE — electric power company

• Siemens — electronic/electrical manufacturer

• Enertrag — wind power producer in Brandenburg

• Hydrogenious Technologies — German start-up company in the area of hydrogen storage technologies

• Nowega — German gas transmission system operator

• Stadtwerke Lingen — public-owned regional energy supplier in the City of Lingen

• Jülich Research Centre

• IKEM Institute for Climate Protection, Energy and Mobility

• British Petroleum (BP) — oil company

• Evonik Industries — the second-largest chemical manufacturer in Germany

• Nowega — German gas transmission system operator

• OGE (Open Grid Europe) — German long-distance gas transmission system operator (formerly E.ON Gastransport)

This list alone makes it very clear how many companies have a great deal of interest in the hydrogen business.

RWE has also reached an agreement with German steel giant Thyssenkrupp in June 2020 on a project to decarbonise steel-making processes by supplying green hydrogen. The hydrogen used in steel and chemical plants has thus far been derived from fossil fuels. Switching to hydrogen from renewable energy sources will allow Thyssenkrupp to reduce its CO2 emissions.

Under the terms of the agreement, RWE will supply the green hydrogen produced in Lingen via a pipeline to Thyssenkrupp’s steelworks in Duisburg. The amount supplied will be sufficient enough to operate the blast furnaces at the steelworks, which will be equivalent to the amount of decarbonised iron required to manufacture 50,000 automobiles every year. Thyssenkrupp is also planning to enhance its own green hydrogen production capacity. In a joint venture with De Nora, a chemical company from Italy, the steel manufacturer intends to expand its electrolysis facilities with a view to increasing its capacity up to one gigawatt. It is worth noting that not only electric power companies but also manufacturers as well are looking to enter the hydrogen business.

Cost Reduction is a Key Element for Successful Hydrogen Production

Uniper, Germany’s leading electric utility, has decided to make hydrogen one of its core business activities. The company is one of the country’s most active researchers in the field of hydrogen energy and has been conducting demonstration experiments since 2013. Its main focus has been on coal-fired power generation, but following the decision by the government, it has been obliged to phase out its coal-fired plants by 2038. The company is now seeking new business alternatives to fossil fuels.

Uniper is already equipped with a number of underground gas storage facilities and, if required, could retrofit its existing infrastructure to operate as a hydrogen storage installation. The company considers, based on the data obtained from the experiments so far, that hydrogen technologies are technically mature enough to be commercially viable.

Agnes Herdick, senior manager of the company in charge of hydrogen energy, says, “Replacing oil and natural gas refineries with facilities to produce synthetic fuels from hydrogen will help to reduce CO2 emissions significantly. Uniper would like to offer 15-MW electrolysers to companies operating refineries in the future and encourage them to produce synthetic fuels from hydrogen.”

The successful commercialization of hydrogen energy will depend on the private sector’s efforts to reduce the costs of production. “Hydrogen is currently relatively expensive to produce,” says Herdick, “Refurbishing the infrastructure imposes a high cost on users, making it all the more difficult to implement in many different industries.”

Uniper argues that the government subsidization for renewable energies should also be applied to hydrogen production, asserting, “We are prepared to provide enough hydrogen for the manufacturing industry to be used in their actual production on the condition that the government will develop the legal framework in an effort to make hydrogen economically viable. As a precondition for provision, it is essential that the cost of producing hydrogen be reduced progressively by utilising economies of scale.”

Japan Aims to Achieve a Hydrogen-based Society

Japan is ahead of Germany when it comes to the practical applications of hydrogen energy. The Japanese government released its Basic Hydrogen Strategy in December 2017, three years earlier than Germany and the EU, setting out its intention to be a leading player in hydrogen technologies by 2050.

Given Japan’s heavy dependence on imported fossil fuels, the strategic goal is to increase its energy self-sufficiency and significantly reduce CO2 emissions through the commercialisation of hydrogen.

The Ministry of Economy, Trade and Industry (METI) is also focusing on reducing the cost of producing hydrogen. The ministry’s Basic Hydrogen Strategy states, “Japan will develop commercial-scale supply chains by around 2030 to procure 300,000 tons of hydrogen annually and ensure that the cost of hydrogen reaches 30 yen/Nm3 (normal cubic meter, a unit used to indicate the volume of gaseous matter). In the future, Japan will try to lower the hydrogen cost to 20 yen/Nm3 to allow hydrogen to have the same cost competitiveness as traditional energy sources when environmental cost adjustments are incorporated.”

In addition, METI is looking to use hydrogen to store electricity, because when electricity demand is low, there could be a surplus of electricity from wind and solar power.

The Basic Hydrogen Strategy sets out an ambitious roadmap as follows: “To further expand renewable energy use, it is necessary to not only ensure the power supply is regular and stable, but also develop technologies for storing surplus power. The power-to-gas (P2G) technology that stores renewable energy electricity as hydrogen is a promising method of controlling long-cycle renewable energy power generation fluctuations that are difficult for storage batteries to address. The key point is cost reduction. Japan will attempt to develop a technology that cuts the unit cost for water electrolysis systems as core power-to-gas equipment to 50,000 yen/kW by 2020 in order to realize the world’s highest cost competitiveness. Japan will attempt to commercialise power-to-gas systems by around 2032, and reduce the cost of hydrogen from renewable energy to as low as that of imported hydrogen in the later future.”

Japan’s scientific community and its private sector are already collaborating on a demonstration experiment. The New Energy and Industrial Technology Development Organization (NEDO), Toshiba Energy Systems & Solutions, Tohoku Electric Power, and Iwatani Corporation completed the Fukushima Hydrogen Energy Research Field (FH2R), a hydrogen production facility in Namie, Fukushima at the end of February 2020, and the project is now up and running.

FH2R has a 20-MW photovoltaic array system installed on 180,000 square meters of land. Here, one of the world’s largest hydrogen production units, with a production capacity of 10 MW, electrolyses water to produce, store and supply 1,200 Nm3 of hydrogen per hour. The produced hydrogen will be used to generate electricity for fuel cells, fuel cars and buses, and other mobility applications.

Germany and Japan share the critical mission of reducing CO2 emissions. Expectations are high for the multiple collaborative activities that will take place in the future among research institutes and private companies in both countries.

Click here to read other articles from the series “Toru Kumagai’s report on R&D trends in Germany”.

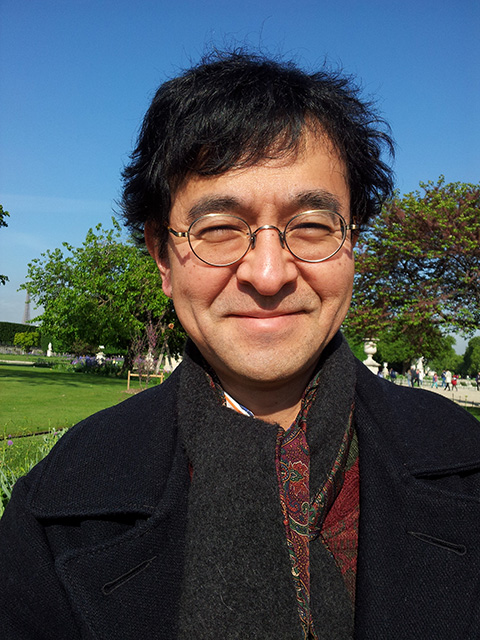

About Toru Kumagai

Born in Tokyo in 1959, Kumagai graduated from the Department of Political Science and Economics at Waseda University in 1982 and joined Japan Broadcasting Corporation (NHK), where he gained a wealth of experience in domestic reporting and overseas assignments. After NHK, he has lived and worked as a journalist in Munich, Germany, since 1990. He has published more than 20 books on Germany and Germany-Japan relations, as well as been to numerous media outlets to report on the situation in Germany.